I would like to request you to join our following services.

It is the smartest way to stay on top of latest Mutual fund, Bonds & IPO News .

Product Updates on whatsapp

Product Updates on Telegram

You will get daily news updates for FREE.

I also request you to spread the world by referring us to the smartest people you know.

To share it with your friends,

just Copy below message it & paste in your group

Subscribe to Our WhatsApp, Email & Telegram Update Service ! https://bit.ly/3ryhxBM

Popular Posts

Get Ready for Shriram Transport Finance AA+Rated NCD

Shriram Transport Finance NCD

Opens 2nd July, 2014

COUPON RATE »

Individuals (Retail and HNI):

11.00% p. a. for 3 years,

11.25% p. a. for 5years

11.50% p.a. for 7 years

Monthly interest payout option available for 5 years and 7 years,

Coupon for Others »

9.85% p. a. for 3 years,

10.00% p. a. for 5 years

10.15% p.a. for 7years.

Senior Citizens (only first Allottee) shall be entitled to get an additional

yield at the rate of 0.25% p.a.

NCDs are proposed to be listed on NSE and BSE.

Allotment will be on a First Come First Serve Basis,

For more info please call.

Thanking you

Regards,

Rajesh Kumar Kathpalia ¤ SMC Global

17,Netaji Subhash Marg,Daryaganj,

New Delhi-110002 Mobile No 9891645052

Email Id: rajesh.ipo@smcindiaonline.com

--

You received this message because you are subscribed to the Google Groups "Product Updates for AMC" group.

To unsubscribe from this group and stop receiving email...

Get Assured Return upto 10% p.a by Investing in IFCI Secured NCD

Now you can download forms of IFCI LTD from our link http://59.144.72.251/IPOPDFGenWeb/brokerOnly.aspx Please find attached Product Note/ and Term Sheet for Public Issue of Secured Redeemable Non-Convertible Debentures by IFCI Limited Thanks & Regards -- Disclaimer: This email and any files transmitted with it are confidential and are solely for the use of the individual or entity to whom it is addressed to. Any use, distribution, copying or disclosure of it by any other person is strictly prohibited. If you receive this transmission in error, please notify the sender by replying to this email and then destroy the message. Opinions, conclusions and other information in this message that do not relate to official business of SMC and shall be understood to be neither given nor endorsed by SMC. Any information contained in this em...

Great

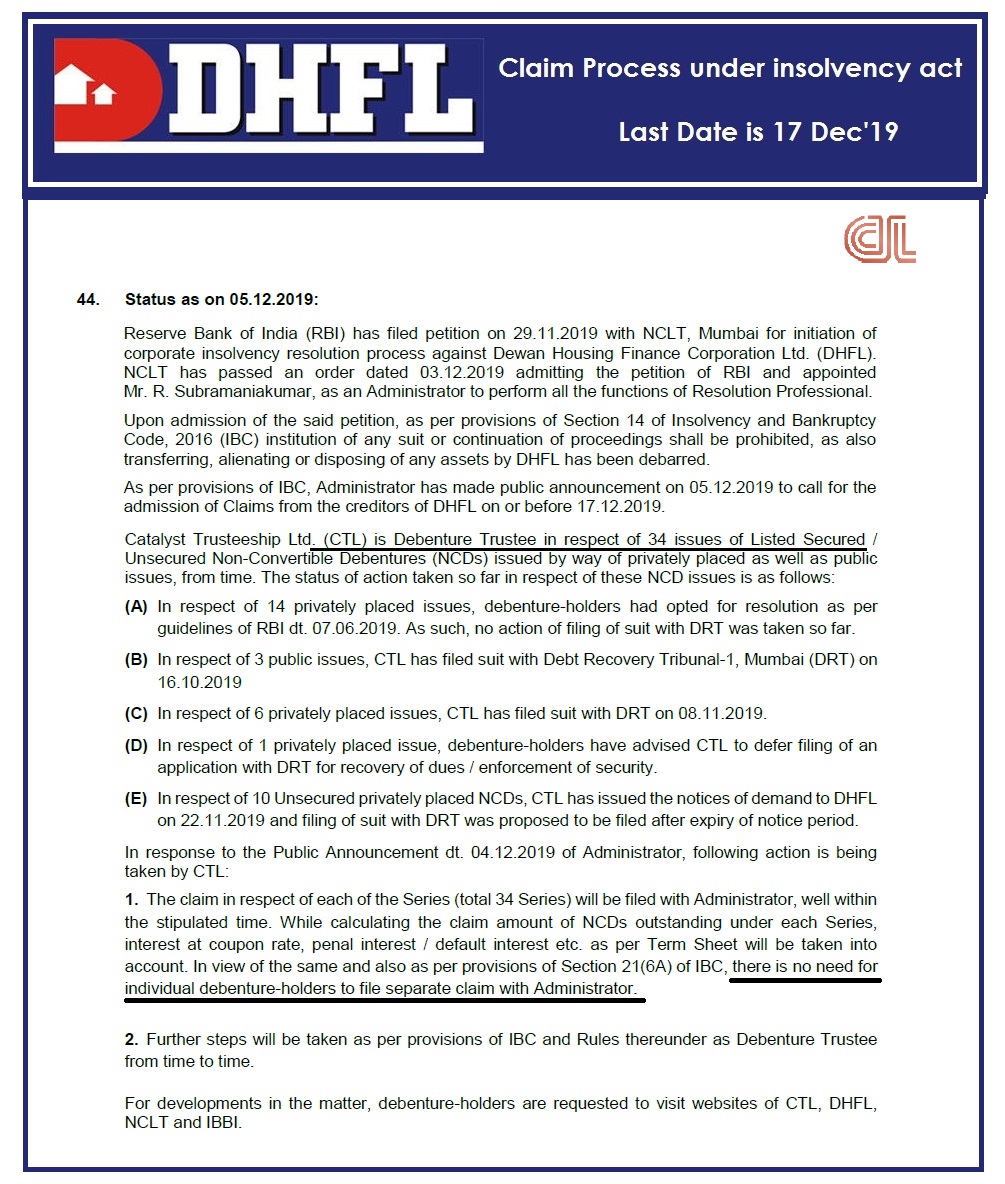

ReplyDeleteI do have DHFL NCDs which were AAA rated.

ReplyDeleteWhat is the fate of that now? Is selling them online bearing a huge loss advisable ?

If those were secured NCDs cant we get atleast the amount invested?