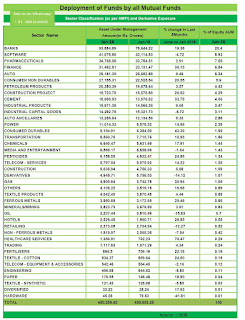

Sectoral Deployment of Bank Credit – June 2016

Home Press Releases Data on sectoral deployment of bank credit collected on a monthly basis from select 46 scheduled commercial banks, accounting for about 95 per cent of the total non-food credit deployed by all scheduled commercial banks, for the month of June 2016 are set out in Statements I and II . These data are also available in the Real-Time Handbook of Statistics on the Indian Economy ( http://dbie.rbi.org.in ). Highlights of the sectoral deployment of bank credit are given below: On a year-on-year (y-o-y) basis, non-food bank credit increased by 7.9 per cent in June 2016 as compared with the increase of 8.4 per cent in June 2015. Credit to agriculture and allied activities increased by 13.8 per cent in June 2016 as compared with the increase of 11.1 per cent in June 2015. Credit to industry increased by 0.6 per cent in June 2016 as compared with the increase of 4.8 per cent in June 2015. Major sub-sectors which witnessed contraction of credit, were food processi