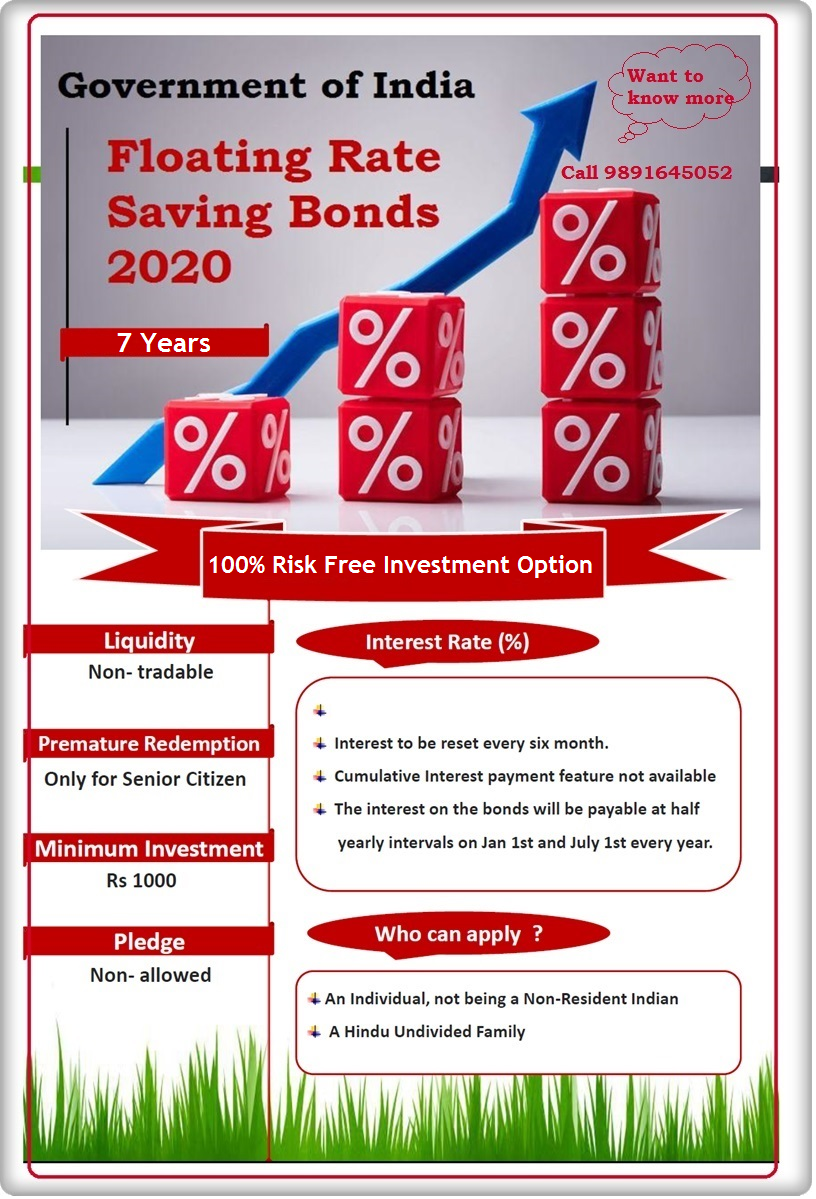

Government of India 7.15% Floating Rate Savings Bonds : A better alternative to FDs ! - 100% risk free investment option

Why Floating Rate Savings Bonds is a better alternative to FDs ? Floating Rate Savings Bonds are a good investment avenue for investors who are looking for fixed return products. These bonds are completely risk free in nature and provide an attractive interest rate of 7.15% compared to a FD i.e. 5.4% (as per SBI website). As, the tax treatment for both the products are same, it implies the post-tax return generated by these bonds will be much higher than a FD. HDFC Deposits - Interest Rate upto 6. 70 % p.a, To know more click here Download Form Watch Video for more details WhatsApp Alert Send Hey to 9891645052 to get Latest updates Chat with Mr. Simple Visit our Blog for Latest New Updates Follow Us On: Invest Online in 54EC Capital Gain Bonds to Save Long Term Capital Gain Tax ...! Invest Online in Bajaj Finserv™ Fixed Deposit & Get .10% Extra Return