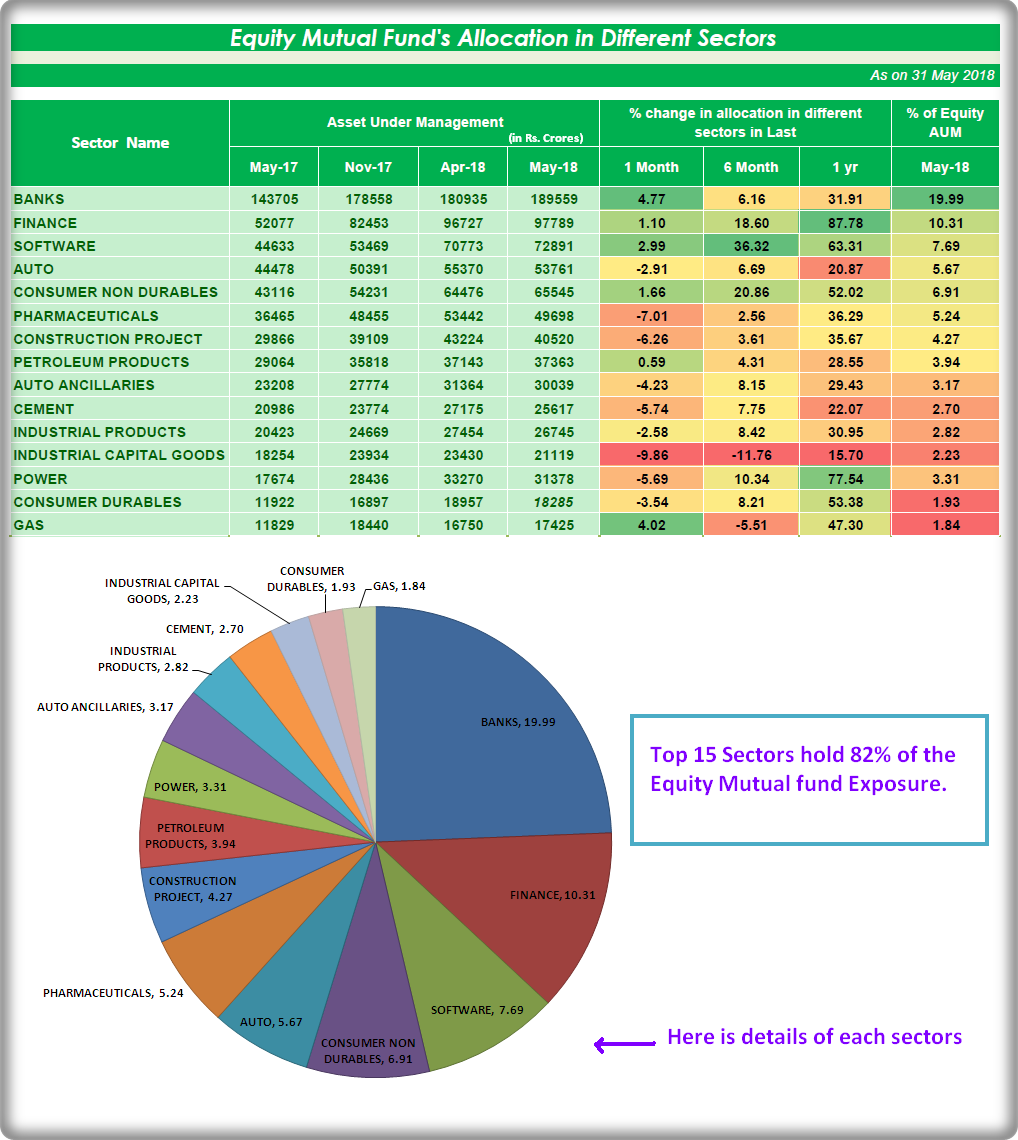

Fund managers are betting big on the IT sector

Fund managers are betting big on the IT sector, on the back of an improving global macro environment, depreciating rupee and rise in IT spends. As per data from SEBI, equity exposure of domestic mutual funds to the IT sector reached an all-time high of Rs 72,891 crore in May 2018 — a year-on-year rise of 63 per cent from Rs 44,633 crore. Equity fund managers' deployment in Banking stocks stood at (Rs 1,89,559 crore) followed by Finance Stocks (Rs 97,789 crore), Software (Rs 72,891 crore),Consumer non Durables (Rs 65,545 crore), and Auto (Rs 53,761 crore) in May 2018.