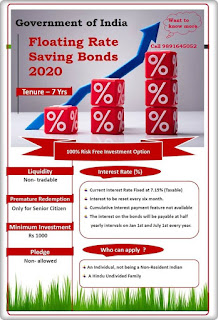

Why settle for 5% on your saving ? when Gov. of India Floating Rate Savings Bonds can give you return @ 7.15% p.a * Tcapply

Why Floating Rate Savings Bonds is a better alternative to FDs ? Floating Rate Savings Bonds are a good investment avenue for investors who are looking for fixed return products. These bonds are completely risk free in nature and provide an attractive interest rate of 7.15% compared to a FD i.e. 5.4% (as per SBI website). As, the tax treatment for both the products are same, it implies the post-tax return generated by these bonds will be much higher than a FD. Premature Facility for Sr. Citizen in Floating Rate Savings Bonds Premature redemption facility is allowed for investors in the age group of 60 years and above. Investors in the age group of 60-70 years can exit after 6 years, 70-80 years after 5 years and 80+ years can prematurely exit after 4 years from the issue date. Download Form Watch Video for more details WhatsApp Alert Send Hey to 9891645052 to get Latest updates Chat with Mr. Simple Visit our Blog