Mutual fund exposure in bank stocks hits a record at Rs 1,05,018 crore

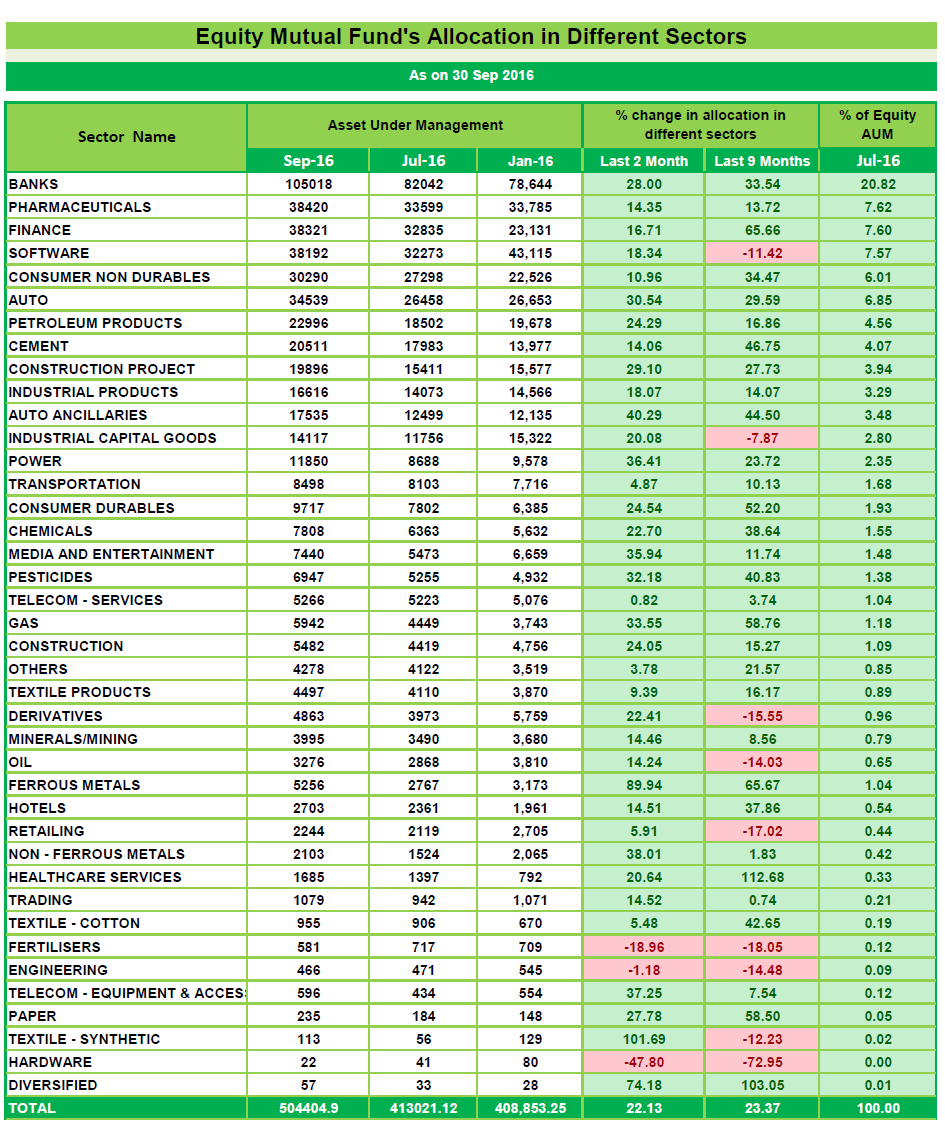

Mutual fund exposure in bank stocks hits a record at Rs 1,05,018 crore Mutual funds ramped up their allocation for bank stocks to a record high of nearly Rs 1,05,018 crore by Sep-end. Fund managers have been raising their allocation to banking since February. Prior to that, they had trimmed exposure to the sector between November and January due to higher bad loans. In percentage terms, exposure to banking stocks was at 20.82 per cent of equity AUM in Sep . Equity fund managers' deployment in pharma stocks stood at (Rs 38,420 crore) followed by finance (Rs 38,321 crore), software stocks (Rs 38,192 crore) and consumer non-durables (Rs 30,290 crore). Here is list of Equity Mutual fund's allocation in Different Sectors...!