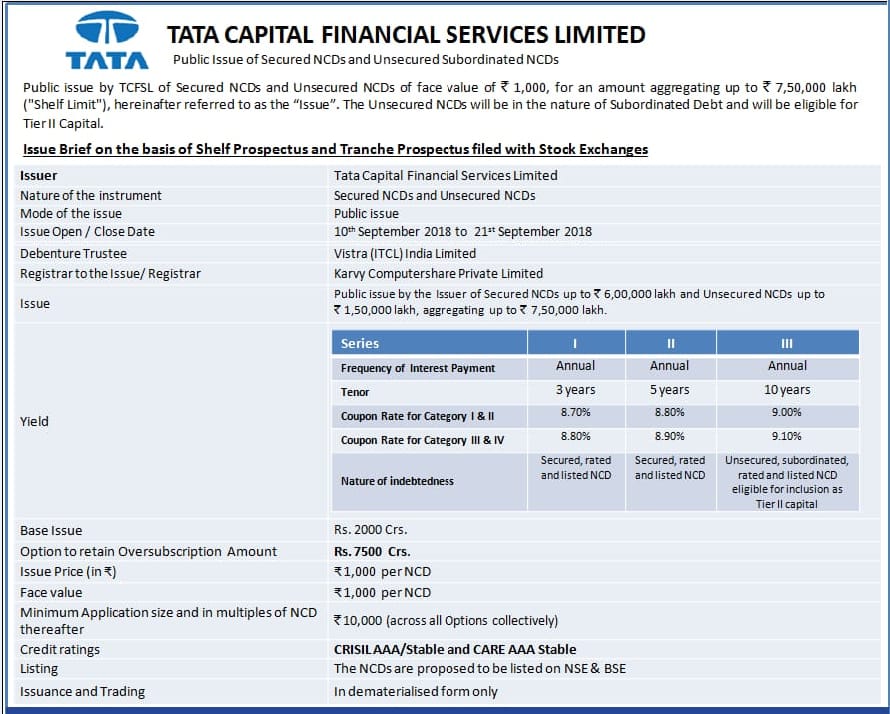

Tata Capital Financial Services Secured NCD- Earn Assured Return upto 9.10%p.a

NCD Public issue of *Tata Capital Financial Services Limited * Issue Size: *₹ 7,500 Crores* Instrument: *Secured Redeemable Non-Convertible Debentures and Unsecured, Subordinated, Redeemable, Non-Convertible Credit Rating: "CRISIL AAA / Stable" by CRISIL; and "CARE AAA; Stable by CARE* Listing:*Proposed to be listed on BSE & NSE* Issuance Mode: *Demat* Face Value: *₹ 1000* Mode Of Application: *ASBA/Non ASBA* Issue Opening Date: *10th September 2018*