Taxation : Sovereign Gold Bond Scheme vs Physical gold

Taxation : Sovereign Gold Bond Scheme vs Physical gold Tax Changes in Sovereign Gold Bond Scheme : There have been some important changes made in taxation to make the Sovereign Gold Bond Scheme lucrative. These changes are made in FY 2016-17 Taxation in case of Sovereign gold bonds : Taxation in case of Redemption/Sale – Sovereign gold bonds are subject to capital gains tax treatment from FY 2016-17 onwards and gains are tax exempt if these bonds are redeemed after 5 years. Moreover, if these bonds are sold on the stock exchanges after 3 years from the allotment date, indexation benefits can be availed to calculate your capital gain or loss. As per the Budget speech "It is proposed to provide that redemption by an individual of Sovereign Gold Bond issued by Reserve Bank of India under Sovereign Gold Bond Scheme, 2015 shall not be charged to capital gains tax. It is also proposed to provide that long terms capital gains arising to any person on transfer of Sovereign ...

Great

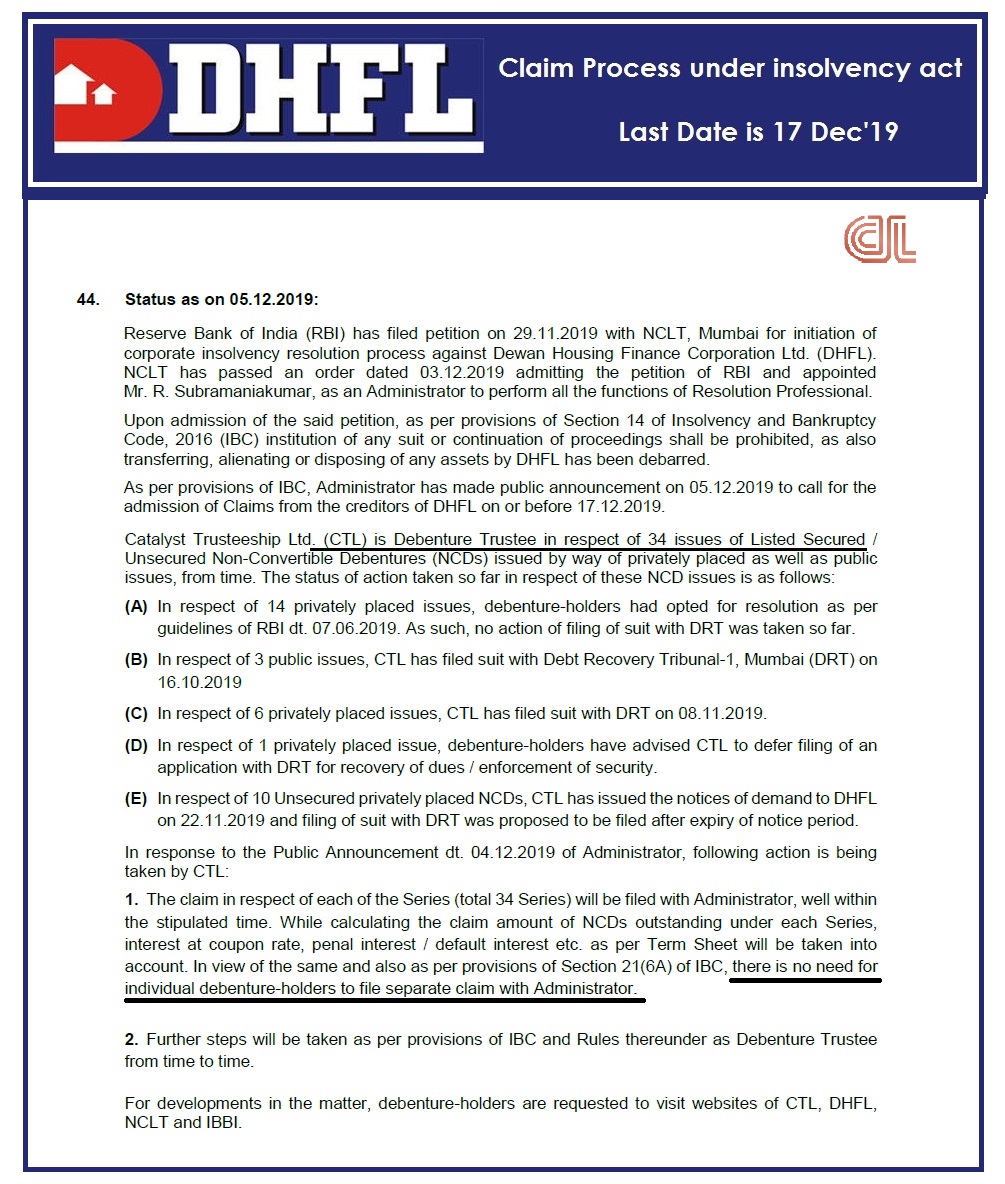

ReplyDeleteI do have DHFL NCDs which were AAA rated.

ReplyDeleteWhat is the fate of that now? Is selling them online bearing a huge loss advisable ?

If those were secured NCDs cant we get atleast the amount invested?