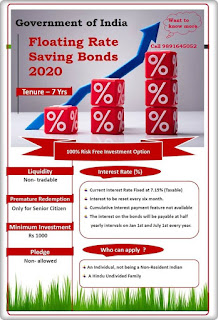

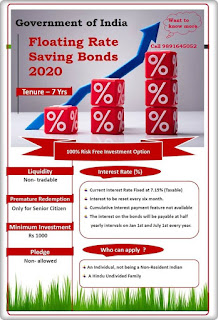

Why Floating Rate Savings Bonds is a better alternative to FDs ? Floating Rate Savings Bonds are a good investment avenue for investors who are looking for fixed return products. These bonds are completely risk free in nature and provide an attractive interest rate of 7.15% compared to a FD i.e. 5.4% (as per SBI website). As, the tax treatment for both the products are same, it implies the post-tax return generated by these bonds will be much higher than a FD. |

|

| Premature Facility for Sr. Citizen in Floating Rate Savings Bonds Premature redemption facility is allowed for investors in the age group of 60 years and above. Investors in the age group of 60-70 years can exit after 6 years, 70-80 years after 5 years and 80+ years can prematurely exit after 4 years from the issue date. | |

|

|

|

|

|

|

|

|

.

--

Disclaimer: This email and any files transmitted with it are confidential and are solely for the use of the individual or entity to whom it is addressed to. Any use, distribution, copying or disclosure of it by any other person is strictly prohibited. If you receive this transmission in error, please notify the sender by replying to this email and then destroy the message. Opinions, conclusions and other information in this message that do not relate to official business of SMC shall be understood to be neither given nor endorsed by SMC. Any information contained in this email, when addressed to SMC Clients is subject to the terms and conditions governing the client contract. Internet communications cannot be guaranteed to be timely, secure, error or virus-free. The sender does not accept liability for any errors or omissions.

Comments

Post a Comment

You are requested to mentioned your full name with email id while commenting.