Did You Know : The bottom 490 stocks of Nifty 500 have outperformed the top 10 stocks on average in last 4 years.

Now – Should you go with relatively undervalued this time?

Are You Fond of Stock SIPs ?

Did You Know? A Stock SIP to own India's Top 10 Largest Companies would cost you around Rs. 21,500/- per month. But, you can own the same basket of Top 10 LARGEST Companies of India* in the DSP Nifty Top 10 Equal Weight Index Fund with a SIP of just Rs. 1,000/- per month, Benefits of Investing via MF vs. Stock SIP: 1. Rebalancing:

- Mutual Fund: Rebalancing happens at the fund level on Quarterly Basis and index is reconstituted on semi annual basis to ensure entry and exit of stocks based on their market cap making their investment journey smooth and hassle free.

- Direct Stock SIP: Rebalancing your direct stocks portfolio individually attracts Capital Gains Tax. 2. Dividends:

- Mutual Fund: Dividends are reinvested at the fund level, ensuring uninterrupted compounding. - Direct Stock SIP: Dividends from individual stocks are taxable at the marginal rate for shareholders. 3. Reasons to buy

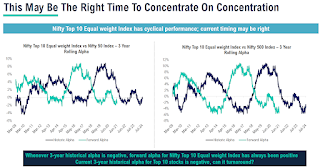

- Weight of top 10 stocks as % of total market capitalization at all time low • Better valuation vs other broader indices • Underperformance in last 3 years vs other broader indices/ active funds

|

Comments

Post a Comment

You are requested to mentioned your full name with email id while commenting.